On Tuesday, we obtained extra affirmation that the Federal Reserve‘s most significant worry — inflation blowing up to 1970s levels — is not taking place, in accordance to the CPI data. Even with its most major ingredient, shelter inflation, retaining main CPI bigger than it ought to be, it’s been hard to speed up the core info.

On the other hand, with the latest banking tension news and the unexpected emergency motion taken by the Fed to safe the banking sector, the problem now is what will generate mortgage loan rates: inflation info, recessionary info, or one thing else we never even see coming?

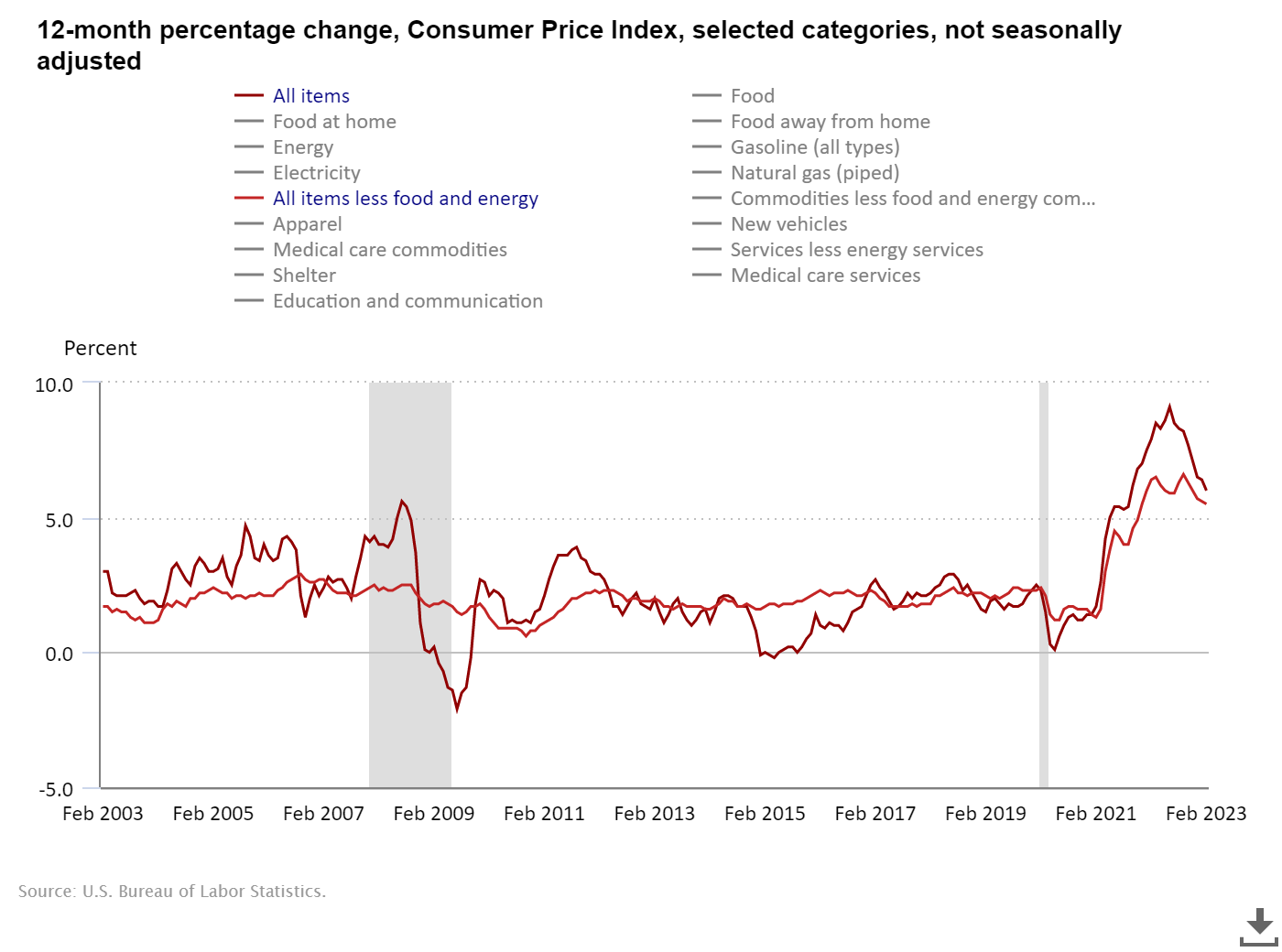

As we can see from the chart beneath, although the inflation information is cooling down, it’s not cooling down quick more than enough for the Fed.

Of program, if the Fed retains chatting about 1970s-style entrenched inflation, I will maintain telling them to depart their disco trousers at dwelling mainly because this isn’t the 1970s. To even have one thing remotely close to 1970s inflation, you need to have a significant housing increase. As you can see below, hire inflation took off in the 1970s.

The shelter part of the CPI details has a weighting of 44.4%, and it now lags today’s reality major time. The chart underneath exhibits that shelter inflation is nevertheless mounting.

Nevertheless, as the CoreLogic rental study info underneath shows, the shelter inflation progress level is collapsing, which is much unique than the CPI shelter report right now. Nearly absolutely everyone understands this: the development rate of main CPI on a true-time basis is substantially decrease than what the report states simply because it lags badly. From the CoreLogic rental study:

Go through additional about why now does not review to 1970s inflation listed here.

From the CPI report: The Shopper Cost Index for All City Customers (CPI-U) rose .4 percent in February on a seasonally adjusted basis, right after escalating .5 percent in January, the U.S. Bureau of Labor Data noted nowadays. In excess of the very last 12 months, the all objects index increased 6. % right before seasonal adjustment.

Inflation info charts can help visualize what is going on. As you can see, the electrical power details is cooling off as oil costs aren’t blowing up greater any longer, and we have far more tricky comps to deal with as the Russian invasion pushed oil price ranges substantially higher final year.

As proven beneath, the food items inflation price peaked in late summer time of 2022 but has yet to drop with extra pace, as vitality has. Of study course, electricity and food stuff inflation are headline inflation. The Fed cares about main CPI and PCE inflation, which excludes foods and energy inflation, simply because these are likely to be pretty wild at times.

Below is a more substantial glance at all the inflation knowledge, broken into distinct groups you can see why it is tough for main CPI to acquire off if shelter inflation fades in the knowledge likely out.

On the other hand, provider inflation info has been having stronger thirty day period-to-thirty day period as the overall economy is nevertheless increasing and work are continue to in make-up need method.

What will push mortgage loan fees now?

We have experienced a outrageous three days in the bond sector. The banking collapse drove revenue into the bond market, taking the 10-year generate down to my important amount of 3.42% intraday, only to bounce again higher appropriate soon after that.

As of the shut on Tuesday, the 10-calendar year produce went back again to 3.68%. A important detail to recall with a ton of 10-year produce charts is that they present what occurs at the shut. We have experienced a good deal of very hot functions in the bond sector that do not exhibit up below.

If, just after the wild weekend of financial institution closures, you felt that house loan prices should have absent decrease on Monday, comprehend that the banking sector is pressured and credit score is acquiring tighter. Think about if Freddie Mac and Fannie Mae were being publicly traded providers with falling stock selling prices — the mortgage credit score earth could have gotten even tighter than we have witnessed right now.

Immediately after using emergency motion this weekend to stabilize the banking sector, the Fed could pull back on their intense discuss on charges, but for them to pivot, they want additional economic agony on the labor front. Let us start tracking the two-12 months generate on this entrance.

The 6% Fed resources group that ended up major talkers on Monday, March 6th, received buried on Sunday, March 12th. We had a historic rally in the two-12 months generate, and a significant component of this was that hedge resources were being really quick on the bond sector not long ago and bought burned poorly. This produced an further wave of obtaining.

Nevertheless, the quick-time period charge is not what drives mortgage prices it’s the extended conclude, which usually means it’s definitely about the 10-year produce. Based on my 2023 forecast and what I see in the labor marketplace, the 10-calendar year yield and house loan costs glimpse about right to me.

My 2023 forecast has a 10-year yield vary in between 3.21%-4.25%, which implies 5.75%-7.25% mortgage rates, assuming the spreads are large. In the Housing Market place Tracker content articles, I speak about the crucial degrees of the 10-calendar year yield at 3.42% and 3.95%. Both of those of these levels have held up so considerably this 12 months. This is why we made the tracker post each and every week to check out to make feeling of all the madness transpiring these days.

We want to consider a minute to contemplate the insanity that happened over the last 7 days and what other banking dangers we have, as much more and much more commercial financial loans could go into default in excess of the up coming year. We have only noticed a number of experiences of this happening so considerably nevertheless, industrial loans are still at risk for additional defaults.

With a lot more men and women performing from dwelling, the will need for business area has gone down radically, so this is just one place to preserve an eye on above the upcoming 12-24 months.

The inflation details came in a little bit hotter than expected on the company facet of the CPI knowledge, but as we can see, the advancement fee of main inflation is cooling off and not accelerating higher like it was in 2022. The Fed is more involved about assistance inflation at this level.

In the wake of the Fed’s intense charge hikes and the ensuing turmoil, we now need to be extra mindful of financial hurt coming out of still left subject. A good illustration of this is that nobody talked about the hazard to British isles pension funds prior to they blew up. And nobody assumed we would need emergency govt intervention to retain U.S. regional banking institutions from likely beneath. Nevertheless, both matters transpired, so now we need to take into consideration what is up coming.

We will shortly listen to the Fed members tackle this subject matter and we’ll see if the recent banking collapse will adjust their tune on far more intense amount hikes at this stage. Outside the house of that, it’s about the labor current market and jobless promises for the Fed.

If jobless promises start out to rise closer to my vital degree of 323,000 on the four-7 days typical, then I imagine the extensive finish of the bond marketplace, which never ever thought in the 1970s inflation premise, will head decrease.

The Federal Reserve has talked about needing increased unemployment to support their aim of preventing inflation. With the latest banking crisis, payroll funds was at possibility, so in idea, they could have permitted work to be misplaced. Rather, they invoked emergency powers to assure individuals would not shed their careers. Recall this when the upcoming occupation-decline economic downturn ultimately transpires.

Now, even so, with jobless promises small and occupation openings higher, we just aren’t there but. I’ll be addressing this in additional element in the upcoming HousingWire Every day podcast, due to the fact we simply cannot enable the banking crisis slide, specifically now that Moody’s has downgraded the banking sector to adverse.