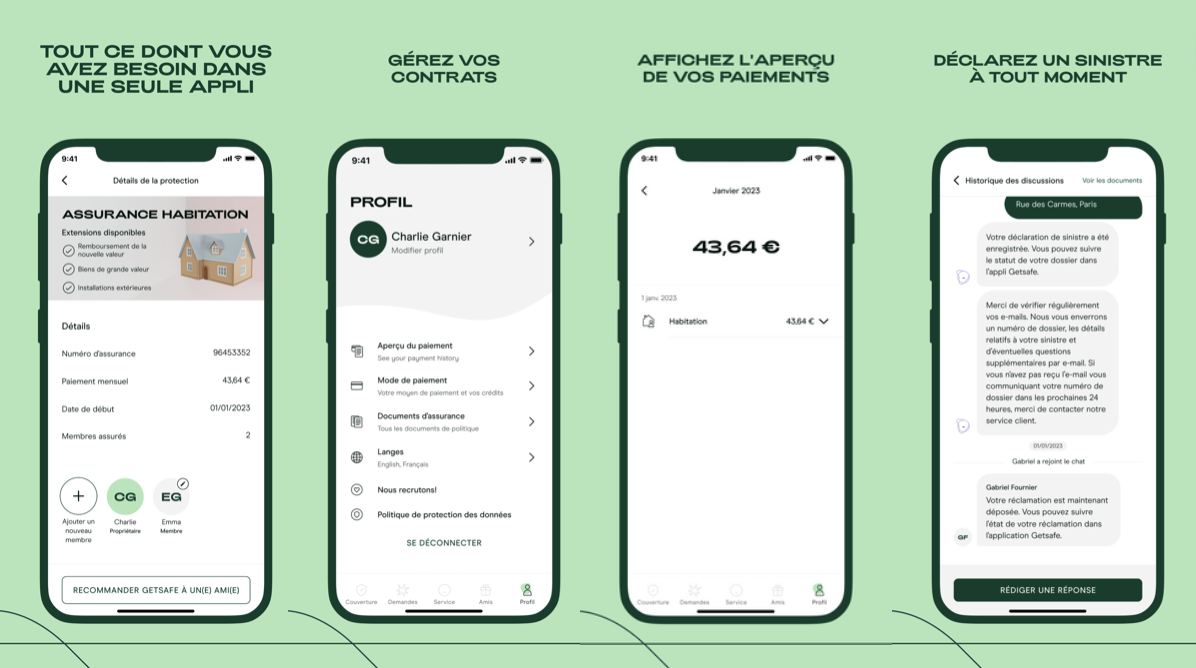

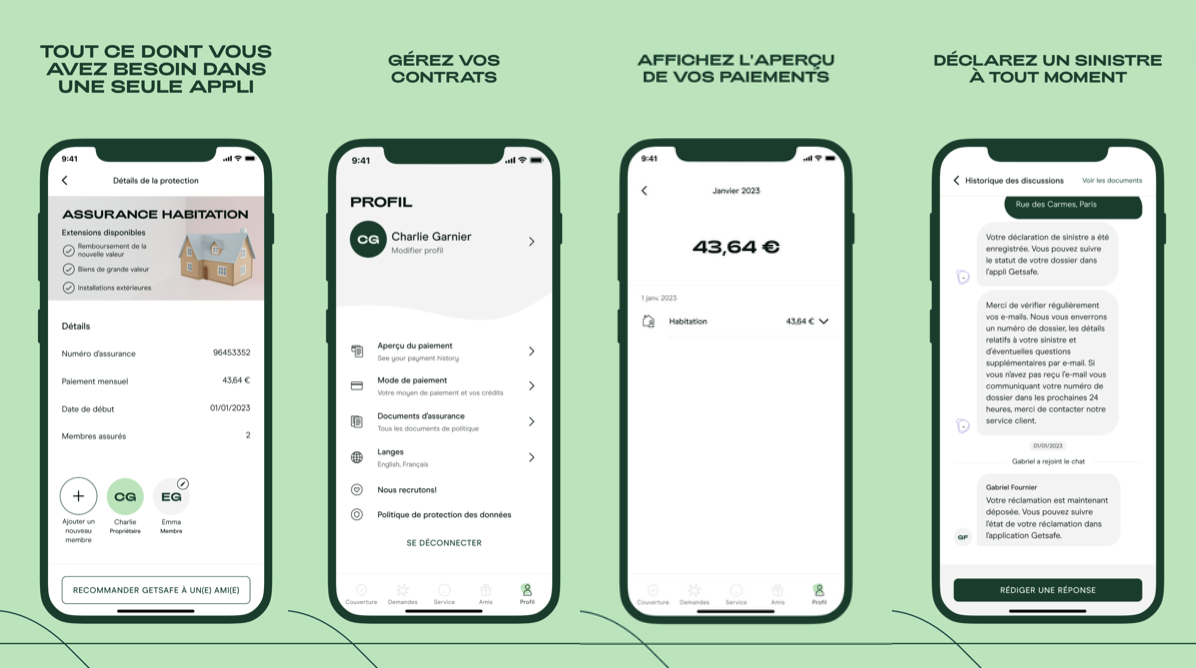

German insurtech startup Getsafe is incorporating a fourth market with today’s products launch. In addition to Germany, Austria and the U.K., Getsafe is now likely to offer you insurance products in France. The enterprise will first supply a residence insurance coverage solution.

Getsafe is making an attempt to disrupt the insurance policies marketplace with a concentrate on digital-very first insurance goods. It sells its solutions instantly to close shoppers by its web page and app as opposed to its German rival Wefox.

In its residence market, Getsafe initially started out with a house contents insurance policies merchandise. But it has significantly diversified its lineup of goods with the addition of personal well being coverage, drone liability insurance, pet well being insurance coverage and even some money products and solutions like personal pension options.

In October 2021, when the corporation declared a Series B extension of $63 million, Getsafe experienced 250,000 consumers. It now has 400,000 customers as it is about to take new buyers in France. Getsafe has its personal coverage license from Germany’s economical regulator, BaFin.

On the French market place, the organization is going to give an all-in-one particular residence insurance policy item. This type of insurance policy products and solutions is notably preferred in France as property insurance plan is a lawful need no matter if you have or you are leasing your dwelling. It ordinarily safeguards the house or apartment towards fires or drinking water damages as nicely as the contents of your home. It also includes residence liability coverage.

It is heading to be appealing to see if Getsafe manages to capture some sector share as this is a crowded market place. All legacy insurance coverage organizations offer you property insurance plan products and solutions and nonetheless stand for the the greater part of contracts. When it arrives to newcomers, French startup Luko also begun with house insurance and now has 400,000 prospects. Final calendar year, Luko obtained Coya, a German competitor. In other terms, Getsafe and Luko now both function in Germany and France.

Lemonade, the publicly traded American insurtech, also introduced its renters insurance policies in France. Though Lemonade carried out very effectively on the inventory market immediately after its preliminary public giving, its shares dropped quite significantly in late 2021 and 2022. The company’s current market capitalization is now just previously mentioned the $1 billion mark.

Lemonade’s general performance could have a chilling impact on the insurtech startup industry. But that does not feel to halt Getsafe as the organization now designs to start much more goods on the French market place thanks to its electronic-1st method and direct-to-consumer distribution strategy. You can hope a non-public wellness coverage products, some journey insurance policies choices or pet well being insurance coverage plans by the stop of 2023.

Graphic Credits: Getsafe