In the fast-paced world of financial trading, having access to the right tools and technology can make all the difference. This is particularly true when it comes to Contracts for Difference (CFD) trading in the United Kingdom. Traders and investors need reliable and efficient API trading platforms to execute their strategies effectively. In this article, we will delve into the world of CFD brokers in the UK and explore the best API trading platform available to traders.

Understanding CFD Trading In The UK

Before we jump into the discussion of API trading platforms, let’s take a moment to understand what CFD trading is and why it is popular in the UK.

CFD, or Contract for Difference, is a financial derivative product that allows traders to speculate on the price movements of various financial instruments, such as stocks, indices, currencies, and commodities, without actually owning the underlying assets. In the UK, CFD trading is highly popular due to its flexibility, leverage options, and tax advantages. Traders can profit from both rising and falling markets, making it a versatile trading instrument.

However, to excel in CFD trading, traders require access to advanced trading tools and platforms, which is where API trading platforms come into play. These platforms provide traders with the ability to automate their trading strategies, access real-time market data, and execute orders swiftly.

The Significance Of API Trading Platforms

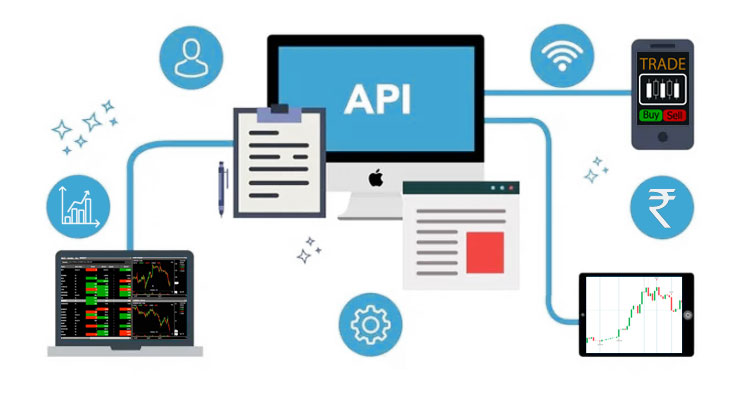

API, which stands for Application Programming Interface, is a set of rules and protocols that allow different software applications to communicate with each other. In the context of trading, API trading platforms enable traders to interact with the broker’s systems and execute trades programmatically.

There are several advantages to using API trading platforms in CFD trading:

- Speed and Efficiency: API trading platforms often offer faster execution times compared to manual trading, reducing the risk of slippage.

- Automation: Traders can automate their trading strategies, which is especially valuable for high-frequency trading (HFT) and algorithmic trading.

- Access to Market Data: API platforms provide real-time market data, allowing traders to make informed decisions.

- Customization: Traders can customize their trading strategies and risk management parameters through APIs.

- Reduced Human Error: Automation reduces the chances of human error during trade execution.

With the understanding of CFD trading and the significance of API trading platforms established, let’s explore some of the best API trading platforms offered by CFD brokers in the UK.

- eToro API Trading Platform

eToro is a well-known CFD broker UK, and it offers an API trading platform that caters to both novice and experienced traders. The platform provides access to a wide range of assets, including stocks, cryptocurrencies, commodities, and more. eToro’s API is user-friendly and supports various programming languages, making it accessible to traders with different levels of coding expertise. Additionally, eToro offers a social trading feature, allowing traders to follow and replicate the strategies of successful investors.

- IG API Trading Platform

IG is another prominent CFD broker in the UK that provides an API trading platform. IG’s API is known for its reliability and fast execution speed. It offers access to a vast array of markets and instruments, making it suitable for traders with diverse strategies. IG’s API is well-documented, making it easier for developers to integrate and build custom trading solutions.

- Plus500 API Trading Platform

Plus500 is a CFD broker that has gained popularity for its intuitive and user-friendly trading platform. They also offer an API that allows traders to automate their trades and access real-time market data. Plus500’s API is relatively straightforward to use and is suitable for traders looking for a straightforward solution to implement their trading strategies.

- Pepperstone API Trading Platform

Pepperstone is a CFD broker known for its competitive spreads and excellent execution speeds. They offer an API trading platform that caters to both retail and institutional traders. Pepperstone’s API is well-suited for algorithmic trading strategies and provides access to various markets, including forex, indices, and commodities.

- Interactive Brokers API Trading Platform

Interactive Brokers is a well-established name in the trading industry and offers a comprehensive API trading platform. Their API, known as the Interactive Brokers API (IBAPI), is highly advanced and suitable for professional traders and institutions. It provides access to a vast array of markets, including global exchanges, and offers extensive customization options.

Choosing The Best API Trading Platform

Selecting the best API trading platform among CFD brokers in the UK depends on your specific trading needs and level of expertise. Here are some factors to consider when making your choice:

- Ease of Use: If you are new to API trading, consider platforms with user-friendly APIs and comprehensive documentation.

- Asset Variety: Ensure that the platform offers access to the financial instruments you intend to trade, such as stocks, forex, cryptocurrencies, or commodities.

- Execution Speed: Look for platforms with fast execution speeds to minimize slippage.

- Customization: If you have a specific trading strategy in mind, choose a platform that allows for customization and automation.

- Support and Resources: Consider the availability of customer support and educational resources to help you make the most of the platform.

- Cost: Review the pricing structure, including any API usage fees, to ensure it aligns with your budget.

Conclusion

In the competitive world of CFD trading in the UK, having access to the best API trading platform can be a game-changer. The platforms offered by reputable CFD brokers such as eToro, IG, Plus500, Pepperstone, and Interactive Brokers provide traders with the tools they need to execute their strategies efficiently and effectively.

Before selecting a platform, it’s essential to assess your trading goals, level of experience, and specific requirements. By doing so, you can choose the API trading platform that best suits your needs and positions you for success in the dynamic world of CFD trading.

In conclusion, when it comes to CFD trading in the UK, finding the right API trading platform can be the key to unlocking your trading potential and achieving your financial goals.

So, whether you are a beginner looking for an intuitive platform or a seasoned trader seeking advanced customization options, there is a suitable API trading platform among CFD brokers in the UK that can help you trade with confidence and precision.

Invest wisely, stay informed, and make the most of the advanced technology available to you through these best API trading platforms in the UK.