Whilst most People almost never get worried about their bank, that faith was shaken this 7 days when quite a few (which include Silicon Valley, Silvergate, and Signature) went underneath. Withdrawal runs and inventory market place chaos ensued, sending ripple effects considerably and broad.

However by some miracle, a person aspect of the financial state that remained astonishingly unruffled was the housing market—which even showed a glimmer of good information.

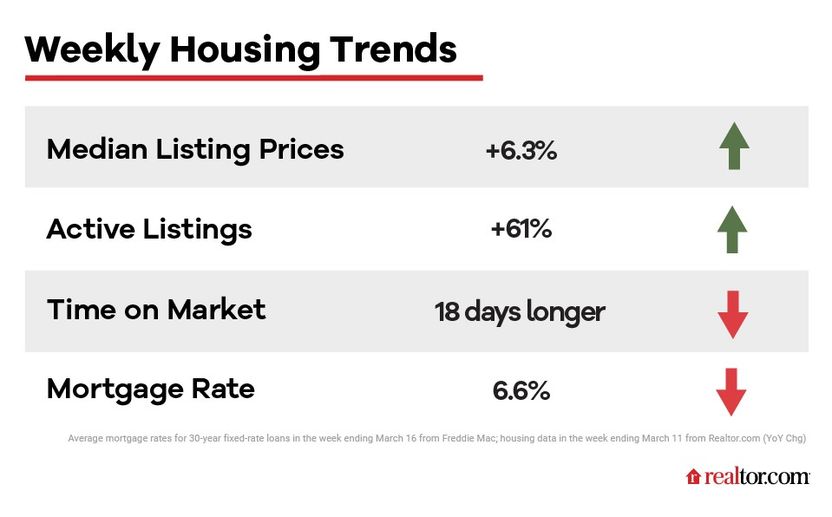

Namely, mortgage charges fell this 7 days to 6.6% for a 30-calendar year set-level mortgage, in accordance to Freddie Mac. This marks the initial drop after five months of pushing upward, cresting last week at 6.73%.

Moreover, homebuyers who are bracing for one more hefty charge hike to strike up coming 7 days when the Federal Reserve meets once more may alternatively obtain some reduction. The Fed, right after all, may possibly be additional intrigued in the quick term in stabilizing an financial system rocked by modern financial institution craterings fairly than taming inflation.

That means mortgage loan rates could truly tumble further more.

And fees apart, other “housing industry indicators were being remarkably steady this week,” Realtor.com® Chief Economist Danielle Hale notes in her most modern investigation.

Here’s what the newest data indicate for both of those homebuyers and home sellers in our newest column of “How’s the Housing Marketplace This Week?“

(Realtor.com)

Why lender failures just can’t shake the housing industry

In February, the median record price of homes hovered at $415,000—that’s 7.8% increased than a yr before. And for the week ending March 11, dwelling charges ongoing growing, but at a slower tempo of just 6.3% as opposed to this exact same week previous 12 months.

“Growth in the common asking selling price of for-sale homes steadied, matching very last week’s tempo, which was the cheapest since June 2020,” says Hale.

A further details level highlighting the housing market’s current rock-strong security is times on current market. In February, listings lingered for 67 times before offering, which is 23 days for a longer time than this identical thirty day period a calendar year earlier. And for the week ending March 11, days on industry rose by just 18 times in comparison to previous calendar year.

“Homes are sitting down on the current market for a longer period than final year, but the hole is not developing,” describes Hale. This suggests that listings might finally start out having snapped up more quickly this spring, with Hale declaring, “The regular seasonal decide-up in housing market speed is occurring.”

The weak link in today’s housing market place

Although housing optimists have motive to be hopeful, pessimists have cause to fear pointing to the conspicuous lack of refreshing dwelling sellers getting into today’s marketplace.

New listings fell by 18% for the 7 days ending March 11 compared to a 12 months in the past, marking a 36-7 days streak of declines. As Hale puts it, “The lack of new sellers is even now a drag on house sales.”

Nonetheless total house stock (of new listings and oldies that have been sitting on the market) carries on to increase, up 61% from this exact week previous 12 months.

“Instead of new sellers driving these raises, lengthier time on market is pushing the number of residences for sale greater,” notes Hale.

Homeowners on the fence about advertising may want to acquire take note that the extremely most effective time to promote a dwelling is coming up quick: Real estate agent.com facts demonstrates that the exceptional week to checklist is April 16-22, when households receive 16.4% a lot more sights from potential buyers, and market for a whopping $48,000 much more on ordinary than they did at the commencing of this 12 months.

All eyes on home finance loan premiums

Where the market heads as the generally hectic spring period kicks in probably hinges on whether or not the Fed hikes prices future week.

“Somewhat decrease interest fees, which include for mortgages, would generally increase property gross sales,” says Hale.

Even so, Hale also factors out that even if charges drop, some sellers who may perhaps have regarded as jumping into the spring homebuying year may pull back for the reason that an economic climate in flux may weaken over-all consumer self esteem.

So, for now, the current market stays in its continuous holding pattern.

“Mortgage premiums are an crucial determinant of exactly where house price ranges will go,” states Hale. “And the outlook for property finance loan rates has gotten substantially cloudier.”